- Polls apart - 4th March 2026

- Repeating on you… - 4th March 2026

- History man - 3rd March 2026

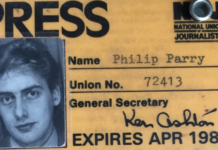

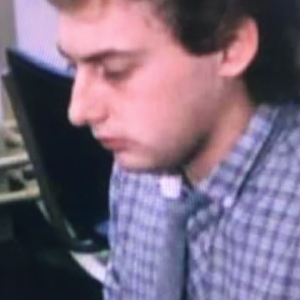

During 23 years with the BBC, and 40 years in journalism, our Editor Welshman Phil Parry has always highlighted absurdity by official bodies, and this is now put centre stage by news the tax system is under scrutiny, and that the Labour party are to abolish the VAT exemption for private school fees.

Sometimes things are so appalling they are laughable.

A case in point is the tax system – especially VAT regulations.

Biscuits, for example, can fall into a higher bracket if they have an overindulgent chocolate coating.

A McVitie’s chocolate digestive trips the wire and faces 20 per cent VAT, but a conventional one is unscathed at nought per cent.

A chocolate-chip cookie is safe.

So is a gingerbread man, just as long as he features chocolate only in dots for his eyes – add any more and he’s taxed at 20 per cent.

Children’s clothes, newspapers, cruises, solar-panel installations, bicycle helmets, coffins and sports lessons all also sidestep VAT.

Is a mini poppadom a crisp?! Is a Jaffa Cake a biscuit?! Is a flapjack confectionery?!

Believe it or not these are all questions tax officials in the UK have had to wrestle with in the 51 years since VAT was introduced.

The tax, which you pay when you buy goods and services, is charged at three rates: the standard 20 per cent; five per cent on things like child car seats, home energy and some other items, with different ones getting away with a nought per cent rating.

Toilet rolls attract 20 per cent VAT but caviar is VAT-free.

Earlier this year, toilet roll maker Who Gives a Crap started a campaign for the ‘roll tax’ to end, saying its research showed 70 per cent of people were unaware of the charge.

In the past few years, VAT has been taken off tampons and related products following a successful campaign.

In fact the UK has more reliefs from VAT than almost any other rich country, and the explicit carve-outs are worth more than £70 billion annually.

Reducing them to the rich-world average would raise around £40 billion in additional revenue.

The Labour Party plans to take a small step in this direction by putting VAT on private school fees, raising a net amount of between £1.3 billion and £1.5 billion.

But even if this is done, tax experts say the UK will still have more than enough zero-rated goods, so creating different ones (which is a distinct possibility), would not help the poorest households.

Yet the ridiculous nature of things do not just apply to HMRC.

In my experience nonsensical rules crop up in many organisations, and sometime they are so closely guarded that I have had to go undercover to expose them!

For instance, a university might have crazy recruitment regulations, a local authority could possess completely illogical employee work systems, or a government body may impose ludicrous rules for benefit claimants.

All of these cases need to be put in the public eye so that people can see how foolish they are!

It’s not just about taxing private school fees…

The memories of Phil’s decades-long award-winning career in journalism (when absurdities in organisations were always reported) as he was gripped by the rare disabling condition Hereditary Spastic Paraplegia (HSP), have been released in a major book ‘A GOOD STORY’. Order it now!

Regrettably publication of another book, however, was refused, because it was to have included names.

Tomorrow – why two hugely controversial figures in the world of Welsh sport have been selected as star attractions at a venue in the heart of Wales’ capital, that declares it offers “a night to remember”.