- Crime and punishment - 8th July 2025

- Striptease - 7th July 2025

- Tears of a clown - 4th July 2025

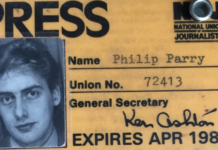

During 23 years with the BBC, and 40 years in journalism, our Editor, Welshman Phil Parry has always exposed major organisations or individuals for back-peddling on what they’ve said and going against the public mood – now new figures underline this, with oil and gas companies again investing heavily in fossil fuels when the earlier public approach was to move away from them, and concern growing massively about climate change.

Why don’t people do as they say they will?

To take as an example, oil and gas companies were supposedly so concerned about climate change (with investors reluctant to give them money because the public distrusted them otherwise), that they pivoted away from relying solely on finding fossil fuels – towards providing energy which did not come from hydrocarbons.

Some even proclaimed it as company policy.

Now though, new figures show that many of those same companies are pursuing investment in fossil fuels once more and down-playing any action on renewables.

For example, BP changed its logo to look like a flower and proclaimed it had a mission-statement of ‘Beyond Petroleum’, but both this oil giant and Shell have been back-peddling on their embrace of green electrons.

BP is making big investments in fossil fuels, but there was no inkling of them in the firm’s forecasts a few years ago. Its hydrocarbon output in 2030 will be just 25 per cent below the 2019 level, rather than the 40 per cent it once touted.

Meanwhile the Chief Executive Officer (CEO) of Shell, Wael Sawan, told an investor day last year that the company is “not particularly differentiated” in the renewables sector.

In July, ExxonMobil paid $5 billion to acquire Denbury, which owns a large pipeline network for getting carbon dioxide to wells that need their recovery enhanced.

In August, Occidental Petroleum paid $1.1 billion for Carbon Engineering, a Canadian startup.

Vicki Hollub, the CEO of ‘Oxy’, as the company is known, has declared: “we’re not going to move away from oil and gas”. Upstream investment generally rose to $500 billion in 2022.

Meanwhile the mood has changed in investment circles, and share prices for oil and gas companies that are turning again to fossil fuels, are on the up. They are even punished financially if those businesses look to renewables.

The shares of the few that do so in Europe trade at a hefty discount to their American counterparts.

In 2022, global crude oil production increased by a record 5.4 per cent, much above its 2010-2019 average (+1.3 per cent a year).

Most of this increase occurred in the Middle East (+13 per cent), especially in Saudi Arabia (+16 per cent), the United Arab Emirates (+15 per cent), Kuwait (+8.1 per cent) and Iran (+5.9 per cent despite sanctions).

Oil production also grew in North America (+6.5 per cent in the US and +2.6 per cent in Canada), as well as in Latin America (+3.9 per cent, thanks to a 3.9 per cent growth in Brazil, while production remained stable in Mexico).

News like this makes me despair – apart from anything else it is important that people DO AS THEY SAY THEY WILL…

The memories of Phil’s astonishing decades-long award-winning career in journalism (when organisations were always exposed for not adhering to their stated policy) as he was gripped by the rare neurological disabling condition, Hereditary Spastic Paraplegia (HSP), have been released in a major book ‘A GOOD STORY’. Order the book now!

Regrettably publication of another book, however, was refused, because it was to have included names.

Tomorrow – how it has emerged that a South Wales conman now in jail for serious drug offences and exclusively exposed by The Eye, who had his legs broken when an illegal deal soured, was a special constable with the police.